Ever read the back of a bottle? “Warning: for best results, use this bottle as directed.” The wise consumer will heed those words for best results. Well, consider this post a form of that. Using a Checkbook Self-Directed Roth IRA LLC can do amazing things for your retirement account. But it won’t really work unless you “use as directed.” In other words, avoid the common pitfalls and remember the rules that govern these accounts. Because if you do, you’ll unlock a convenient, flexible way to invest using your retirement funds—and potentially build yourself an amazing nest egg.

Warning: Don’t obtain a credit card in the name of the Self-Directed IRA.

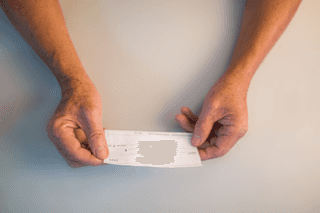

One of the main attractions of a Self-Directed Checkbook Roth IRA LLC? Simple. The ability to write checks directly from the IRA’s LLC account. However, obtaining a credit card in the name of the Self-Directed IRA LLC is a major no-no. The IRS views this as extending credit to the IRA, creating a “prohibited transaction.” This type of transaction can disqualify the entire IRA, which means you lose your tax benefits—and may have to pay penalties.

Instead, manage expenses and income through the checkbook or debit card linked to the LLC’s bank account. Keep the transactions straightforward and transparent to maintaining compliance with IRS regulations.

Warning: Don’t use the Checkbook Self-Directed Roth IRA LLC assets personally.

Using the assets of your Checkbook Self-Directed Roth IRA LLC for personal benefit is a clear violation of IRS rules. This includes any personal use of real estate owned by the IRA, whether for vacations, personal business, or as a primary residence. The IRS categorizes such actions as self-dealing, which is a prohibited transaction.

The assets held within the Self-Directed IRA must be used exclusively for investment purposes. Personal use not only jeopardizes the tax-advantaged status of your account but also triggers penalties and taxes on the amount involved. It’s crucial to maintain a clear separation between personal assets and those held within the IRA LLC. This distinction ensures that you reap the full benefits of your retirement strategy without risking unintended penalties.

Warning: Don’t perform repairs on real-estate property owned by the Checkbook Self-Directed Roth IRA LLC. You’re a “disqualified” party.

While it might seem cost-effective to perform repairs or maintenance on a property owned by your Checkbook Self-Directed Roth IRA LLC, doing so will be a violation of IRS rules. As the owner of the IRA, you’re considered a disqualified party. You therefore can’t provide services to the IRA-owned assets. Engaging in such activities can be construed as contributing “sweat equity,” which is prohibited.

Outsource all your IRA-owned properties to third-party professionals. By paying for services through the IRA LLC’s funds, you ensure compliance and protect your IRA’s tax-advantaged status. Although it might seem counterintuitive to hire out services you could perform yourself, this separation is critical for maintaining the integrity and compliance of your investment.

Warning: Don’t deposit personal funds into the Checkbook Self-Directed Roth IRA LLC bank account.

Maintaining the integrity of the Checkbook Self-Directed Roth IRA LLC will require the strict separation of personal and IRA funds. Depositing personal funds into the LLC’s bank account is a serious violation of IRS rules. This action can be seen as a contribution beyond the annual limits or as a commingling of personal and retirement funds, both of which can disqualify the IRA.

All funding for investments and expenses should come directly from the IRA account. Adhering to this rule makes sure your Self-Directed IRA remains compliant with IRS regulations. This preserves its tax-advantaged status. Any personal contributions must be made according to the annual contribution limits and procedures set forth by the IRS.

Contact TurnKey IRA at 844-8876-IRA (472) for a free consultation. Download our free guide or visit us online at www.turnkeyira.com.