It’s a simple formula. Your IRA owns an LLC, which owns a checking account. This puts you, the IRA holder, in control of a checking account. And when you have a Self-Directed IRA—the kind that can own an LLC within it—then you have all sorts of options for legitimate retirement investing within that account. But while this formula might sound simple to many, it’s also intimidating for many new investors. So let’s simplify things. Here are some ways you can start a “Checkbook” Self-Directed IRA LLC like the one we described—broken down into individual steps.

Step #1: Open a Self-Directed IRA

It all starts with this foundation. You have to have a Self-Directed IRA, which means that you’re working with a Self-Directed IRA broker who is capable of executing more than stock trades. You can own LLCs within a Self-Directed IRA this way. Once you do, it opens up all sorts of other possibilities.

In this case, the LLC is a specific type: a Single Member LLC. This means that the LLC has only one owner. And you’ll have to file the proper paperwork for the LLC, such as registering your LLC with your state and obtaining an EIN from the IRS. Once you do, you’re ready to move forward.

Step 2: Transfer Retirement Funds

Once you have established your Self-Directed IRA, the next step is transferring or rolling over funds from existing retirement accounts. There are some options here. Your funds could be from former employer retirement plans like a 401(k), or from other IRAs.

To switch over funds, you need to initiate a transfer to your new Self-Directed IRA custodian. That’s the entity that will manage your new account and allow for investments in an LLC. This step is crucial: it ensures that your retirement funds will move without incurring any penalties or taxes.

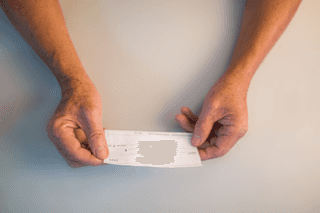

Step 3: Establish a Checking Account

With your Single Member LLC established and retirement funds transferred, you can now set up a checking account under the name of the LLC.

As the named manager of the LLC, you have the authority to open this account at any bank of your choice. Think carefully. After all, this checking account will act as the financial hub for your Self-Directed IRA LLC, handling all investment transactions. Select a bank offering convenient access and favorable terms for business accounts.

Step 4: Fund the Checkbook Self-Directed IRA LLC

Once the checking account is open, the next step is to fund the checking account itself. Your Self-Directed IRA custodian will process an investment directive. This is essentially your instruction to invest the IRA funds into the newly established LLC.

The custodian will then wire the designated funds from your Self-Directed IRA to the LLC’s checking account. This step transforms your IRA funds into capital ready for investment under the LLC structure. Remember to keep clear records at every point so that your accounts can stand up to any scrutiny.

Step 5: Investing with the New Arrangement

With your Self-Directed IRA LLC’s checking account now funded, you can start making investments. This is where the flexibility and power of a Checkbook IRA LLC really show themselves. You can directly purchase assets such as real estate, private equity, precious metals, or other non-traditional investments. And the convenience? You can simply write checks or transfer funds directly from the LLC’s checking account.

Contact TurnKey IRA at 844-8876-IRA (472) for a free consultation. Download our free guide or visit us online at www.turnkeyira.com.